The most interesting thing about the Food-Tech space is that every average person is expected to eat at least thrice a day. This one fact alone ensures that there is a definite market for Box8. Especially in an IT-savvy city like Bangalore where the majority are migrants and have limited capability or will to cook. Finding a good cook is another challenge that we will get to later.

Given the scenario, you will end up ordering the majority of meals. Where there is a need, there is an app. No surprise that food delivery apps flooded the market and even now, users have access to a crazy assortment of options. To understand why Box8 is phenomenal, you will need to understand how we got here.

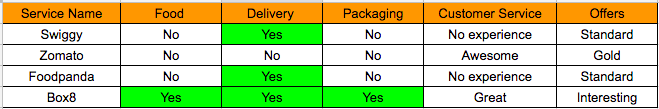

Who are the major players?

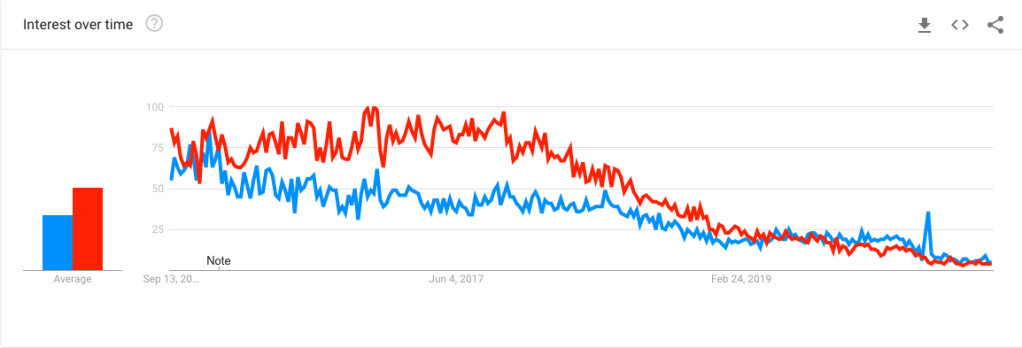

A Google trends search of the major food delivery players reveals how each one of the major players is trending. It is a known fact that once one downloads the app, you won’t be searching anymore but these trends still give a sense of each player’s heartbeat.

- Swiggy: Their growth direction has been the most consistent constantly towards the upper direction.

- Zomato: They did a great job achieving consistent growth till mid of 2015 and then undoing all the efforts from there on. However, since early 2018, they caught on to their game by releasing Zomato Gold.

- Food-panda: A venture builder’s (RocketInternet) subsidiary, had lots of manufactured growth till August 2015 when the CEO quit amid embezzling and other allegations. It’s been a steady decline ever since. Not sure, if the Ola acquisition helped !!

The most amazing part of the curves is how Swiggy systematically ate up Zomato‘s and Foodpanda‘s growth.

Box8 given the other’s scale is still a smaller player. Despite the numbers, it’s got plenty going for it.

What are the key variables?

The entire business of a food tech has primarily two components: Food & Technology. Each player can build a proposition by finding their niche. The entire cost structure is spread across three terms: Food + Delivery + Customer Service.

As can be seen, Swiggy & Foodpanda compete on a similar front with both playing the scale game and trying to improvise on their delivery service and eke out an edge there. They are largely operational tech firms.

Zomato has deeply invested in the experience aspect given their roots and very strong competition on the non-operational aspect of the business. Their edge is primarily around design and the tech part of things.

If we look deeply, we realise only Box8 is a true Food-Tech firm playing in the entire value chain. By doing something like this they can have better margins but will take greater time to scale as can be seen in their growth trajectory.

Inference

In my experience, I have largely relied on Box8 in recent times because I both like the food and also because they have managed to commoditise their offering in terms of limited food types and deliver them in standard boxes. The packaging should allow them to scale their delivery smartly when they grow in size.

This is a lesson to learn from the business of Pizza firms who have largely been the first food tech players. By creating a niche of food offerings and building standard packaging for the same, they manage to control the entire chain and thereby can ensure greater quality control and also be able to deliver more efficiently.

Box8 thereby seems like a replica of Pizza firms but for Indian food. Their business model is as impressive as the food they deliver.

Edit: Now, that Amazon has entered the space, Box8 has much to gain at the cost of delivery-centric plays like Zomato and Swiggy !!

Analysis

A closer look reveals that the niche remaining players like FreshMenu also seem to be waning in interest along with Box8. While search is not an accurate reflection of an active user base since loyal customers will be ordering through apps and not searching, the graph reflects slower growth in user base or saturation.

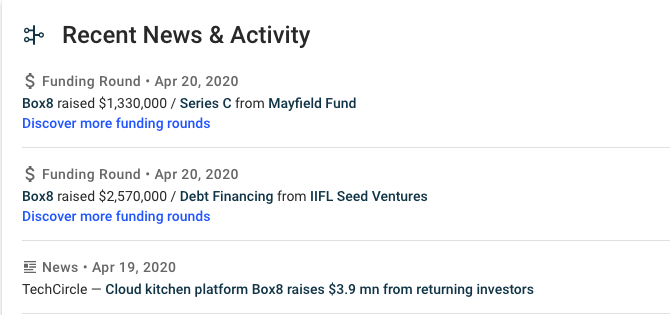

Without COVID having wreaked havoc, the smaller players are likely to fold or go lean to be able to survive the times. The change in macro conditions with ed-tech and agri-tech are the hot ones. Furthermore, it will become harder to raise money down the road.

Interestingly, Box8 seems to have raised some money in the form of Debt. This shows a sense of confidence in the ability to repay the capital. Startups find it incredibly hard to raise debt due to extremely high risk.

Conclusion

Without internal metrics or data, it’s difficult to make a call on the current state of affairs of the firm. While the macro conditions are negative, they might just be able to thrive because of the collapse of competition. Moreover maybe even rule the category of Indian Food segment.

I guess, carving out a niche and defending the space with micro optimisations and customer success is not a bad idea. While you trade growth and time for better unit economics, it might well be the right strategy to continue to survive in a specific segment and fight another day.

The cumulative amounts raised(~30 million USD) are also more conservative compared to the billions by Zomato and Swiggy. This suggests, they still have a shot at being able to exit the firm. Additionally, make money if they get a decent valuation down the road. I don’t think, Zomato or Swiggy’s common shares are worth anything given the massive fund-raises. They will find it difficult to get past the preference stack.